Computer Applications for Business – Week 6 Assignment

MS Excel: Update Payroll

Using Microsoft Excel online or installed version of Microsoft Excel complete the following assignment

NOTE: To complete the assignment you will need to start with this file, Lab 3-2 PHM Reliable Catering Weekly Payroll Report

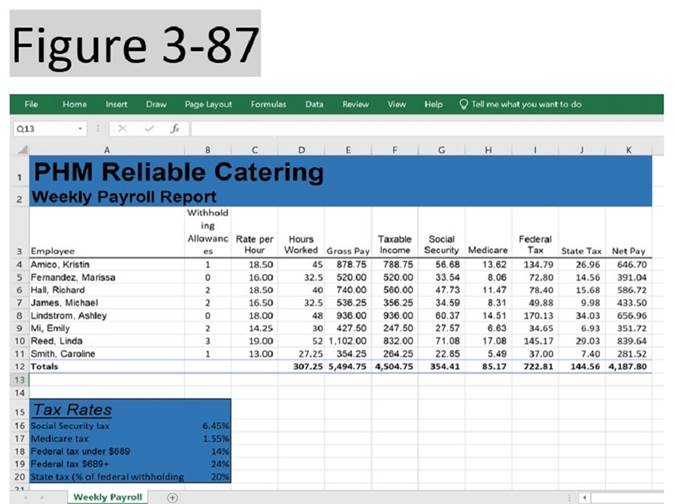

Problem: PHM Reliable Catering is a company that provides catering services to both small and large businesses. You have been asked to update the weekly payroll report to reflect changes in personnel, to update certain mandatory deductions, and to add overtime computations. The final worksheet is shown in Figure 3–87.

1.

Open the workbook, Lab 3-2 PHM Reliable Catering

Weekly Payroll Report.

2.

Save the file as CS155Week6LastnameFirstname.

Ensure that you use your Lastname and Firstname in filename.

3.

Delete rows 12 through 14 to remove the

statistics below the Totals row.

4.

Delete column B. Set column A

width to 31.00 and columns B through K to 11.00. Select row 3 and set text to

wrap in this row using the Wrap Text button (Home tab | Alignment group), and

then set the row height to best fit.

5.

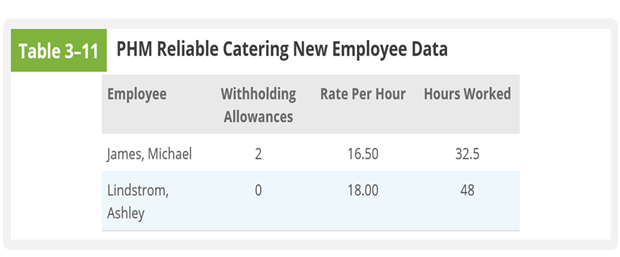

Delete the record for the employee Evans,

Timothy. Add two blank lines directly above the row for Mi,

Emily, and add the information for the two new employees listed in Table 3–11.

6.

Replace one of employee’s names with your name.

.

7.

If necessary, use the fill handle in cell E6 to

copy the gross pay formula to the rows of the two new employees.

8.

Add the Tax Rates information shown in Figure

3–87 in cells A15:B20 to your worksheet.

9.

Change the font size in cell A1 to 28-point.

Change the font size in cell A2 to 18-point. Change the font in cell A15 to

18-point italic and underlined. Change the row height for rows 1, 2, and 15 to

best fit.

10. Insert

three columns to the right of the Gross Pay column. Add the column titles

Taxable Income, Social Security, and Medicare in cells F3:H3. Center the

contents of cells B3:K3. Calculate the Social Security and Medicare taxes in

columns G and H by multiplying the tax rates in the Tax Rates table by the

Gross Pay.

11. Federal

tax calculations must take into account two tiers of income tax, which are

applied to the taxable income. Calculate the taxable income, which is the Gross

Pay — (number of withholding allowances * $90).

12. Calculate

the federal tax withheld. If an employee has a taxable income of greater than

or equal to $689, then the federal tax withheld equals $110.85 plus the federal

tax rate found in cell B19 multiplied by the taxable income in excess of $689.

If an employee’s taxable income is $689 or less, the federal tax withheld

equals the taxable income multiplied by the federal tax rate found in cell B18.

Use the IF function to calculate the federal tax in Column I.

13. State

tax is calculated as a percentage of federal tax. Use the tax rate in the Tax

Rates table to calculate state tax in column J.

14. Calculate

Net Pay in column K, as Gross Pay — Social Security, Medicare, Federal Tax, and

State Tax.

15. Use

the background color of your choice for the ranges A1:K2 and A15:B20.

16. Center

the range B4:B11. Apply the currency style with two decimal places, no dollar

signs, and negative numbers in black and parentheses to the range C4:C11 and

E4:K12.

17. Apply

a Thick Bottom Border to the range A3:K3. Apply a Thick Outside

Border to the range A15:B20.

18. Change

the sheet tab name to Weekly Payroll and the tab color to match the color used

as background color in cell A1.

19. Preview the worksheet. In page setup fit the worksheet to one page in landscape orientation.

Save

file after completing and submit work by attaching file to week 6 assignment

submission area.

|

Grading Criteria

Assignment |

Maximum Points |

|

Deleted rows 12 -14 and Delete

column B Deleted record. Two employees

added, one students name and copied

gross pay over to new entries |

21 |

|

Column Widths: A - 31 pts and columns B -K to 11 pts |

4 |

|

Row 3 wrap text.

Row height 1- 3 ,15 best fit |

5 |

|

Tax Rates

information shown in Figure

3–87 in cells A15:B20 |

4 |

|

Font size A1 to 28-pt, A2

to 18-pt, A15 to 18-pt italic and

underlined |

6 |

|

Insert three columns to right of

Gross Pay column. Column titles Taxable Income, Social Security,

and Medicare. |

6 |

|

Formulas: ·

Calculated Social Security and Medicare taxes ·

Net Pay, and Federal tax, state tax withheld |

20 |

|

Background color changed

A1:K2 and A15:B20. Center B4:B11 |

6 |

|

Formatting: ·

Currency style two decimal places, no

dollar signs, negative numbers in black and parentheses to C4:C11 and E4:K1 ·

Cell contents B3:K3 centered, thick Bottom

Border A3:K3 and Thick Outside Border A15:B20 |

10 |

|

Sheet tab name to Weekly Payroll and tab color to match

background color A1 |

4 |

|

Fit to one page in landscape orientation. |

4 |

|

Filename CS155Week6lastnamefirstname |

10 |

|

Override for

incorrect file type, template used or incorrect content/file |

|

|

|

100 |